make money, make money!

Everyone should know how to make their money, make money! And with a few simple tools and understanding, you can! As a way of understanding saving, income, investment, retirement, and stocks, examine the information below and answer the questions.

part i: savings and income

How do you balances your income and expenses, while “saving” at the same time? Let's start with the basics:

ANALYSIS QUESTIONS:

- earned income: often called compensation, or total compensation, is the total wage or salary and benefits that an employee receives.

- unearned income: income that you don’t work to earn, but rather “comes to you” via investments and savings accounts

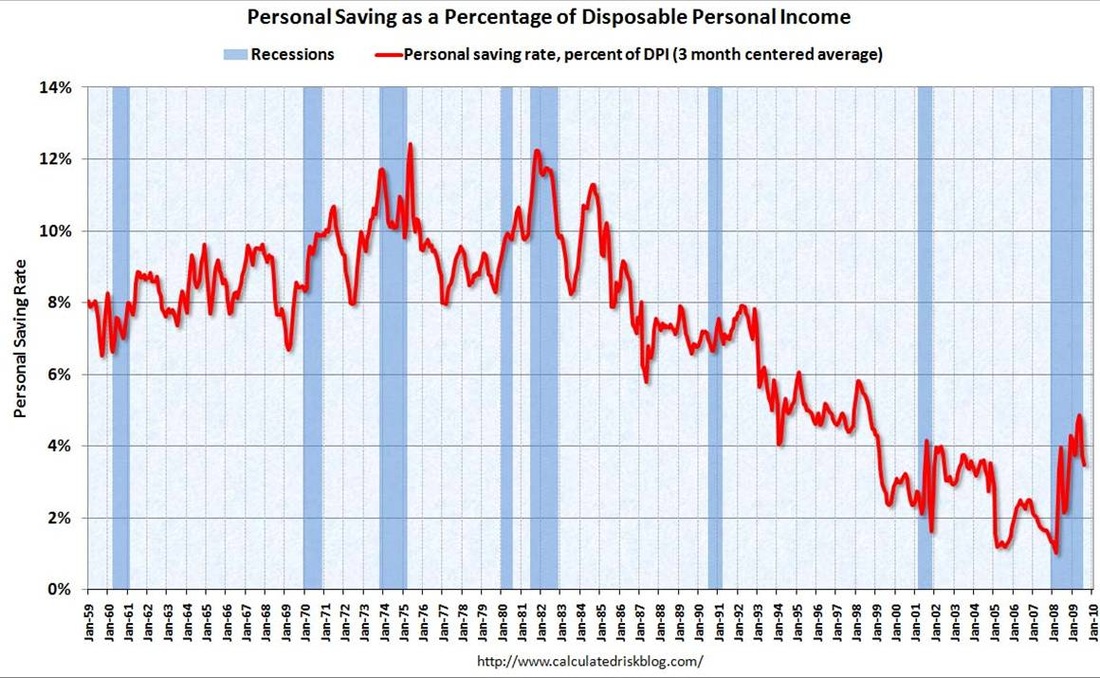

- As a rule, 10% of your income should go to saving, while 1-5% should go to investment…In the early 1990s, South Korea "led the way" with citizens saving about 23% of their income, while at the same time, the U.S. saved about 7% of its paycheck. Since the economic meltdown of the late 2009s, the Germans lead the world, saving 10% of their income; the U.S. barely saving 1.2% in 2008.

ANALYSIS QUESTIONS:

- What is the difference between "earned and "unearned" income?

- Examine the Personal Savings graph above. When did the U.S. "save the most"? When did it significantly decline? In your opinion, why don't American save more?

part ii: investment and retirement

We've all played Monopoly and dealt with the cards above. It's great when you get these cards cuz you make money! So, how do these work in real life? Again, let's start with some basics:

ANALYSIS QUESTIONS:

- The difference between "savings" and "investment" deals with longevity: how far away are your goals?

- "Savings" is usually for short-term goals in very “safe” accounts. The amount you save is more important than what you earn on your money, (called a “return”. Plus, your saved money is more “liquid”, meaning you can access it quickly without penalty.

- "Investing" is for goals that are more than five years away. The phrase “make your money grow” is when you can actually get more money by putting your money into an investment.

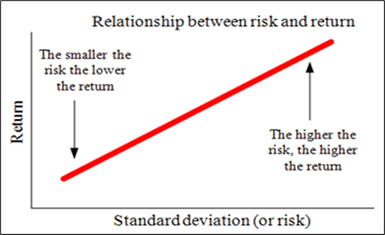

- Investments have more risks and the possibility for losing the money you put into it. In general, the more risk you take, the more potential return there will be…

ANALYSIS QUESTIONS:

- What is the difference between "savings" and "investing" goals?

- What is meant by the term "return"?

- What is meant by the term "liquid"?

- If you want to make more money, should you "invest" or "save"? If you want to make sure your money stays "safe", should you "invest" or "save"?

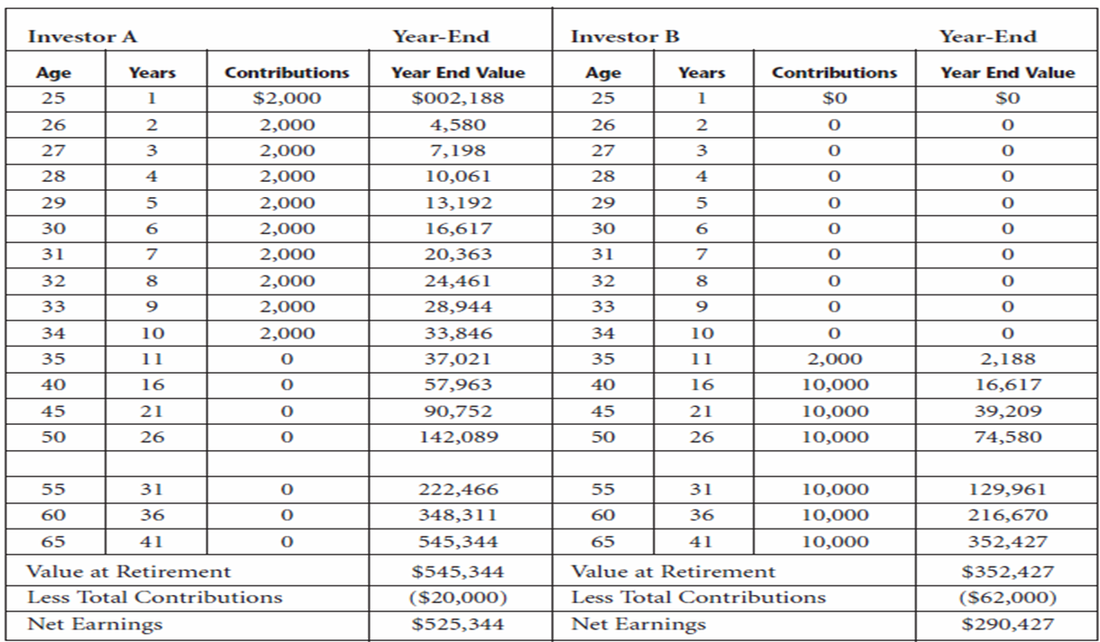

Examine the chart above and answer the conclusion questions:

The answer to #3 lies in the phrase "compounded interest". The reality is, the equation is simple:

- Explain the differences between the investment plans of "Investor A" and "Investor B".

- By the time each person retires, how much will "Investor A" make? "Investor B"?

- ANALYSIS: Why? What conclusion can you draw as to why "Investor A" make more money, where Investor B actually invested more money, yet "returned" less?

The answer to #3 lies in the phrase "compounded interest". The reality is, the equation is simple:

- Invest early with $2,000. For "Investor A", his "interest rate" is quite high: 9.4% per year.

- Investor A's annual contributions are $2,000 per year, BUT as investment makes interest, you earn INTEREST on that initial INTEREST as well! That's what's called "compound interest".

PART III: high risk, high reward

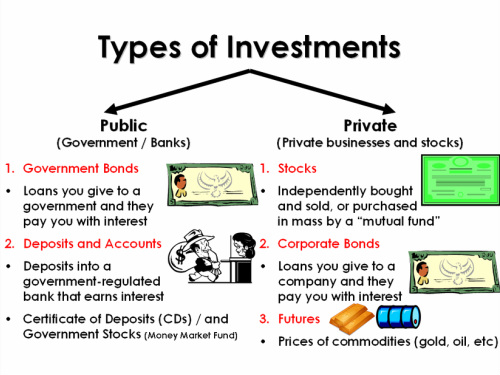

There are many kinds of investments to help your money make money. Remember: investments are designed to gain "returns" via interest. "Savings" are low-risk, low-interest-returning decisions, and for this part of the activity, we'll be focusing on investment. Examine the chart above:

- You can see that there are two (2) types of investment: public and private. "Public", like "public schools" are associated with the government and banks. "Private" like a "private school" is independent from the government and is run by individuals. You can see that both categories have bonds, but from there, they differ. Use the "Investment Cheat Sheet" provided and refer to the chart above, to try to fill in the chart below.

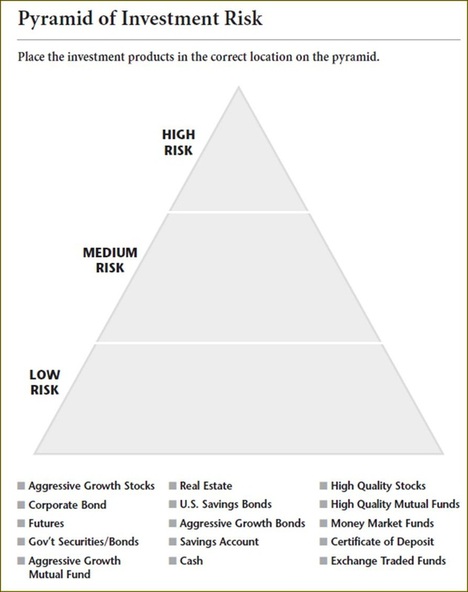

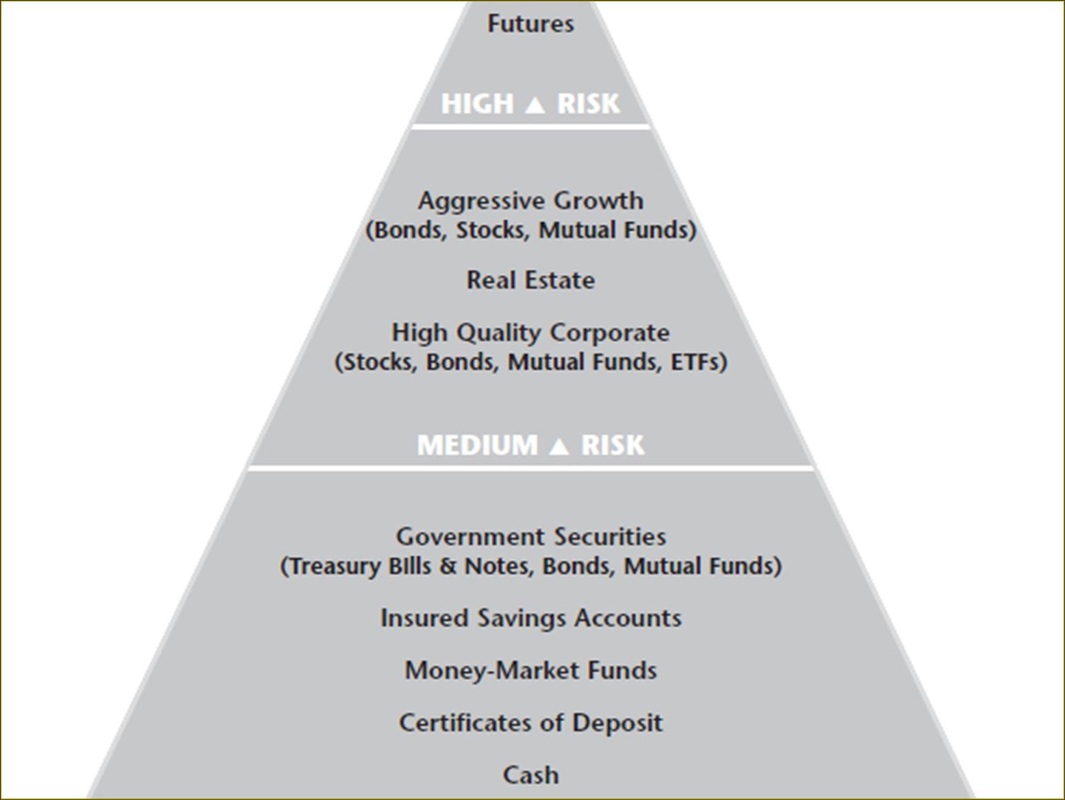

Look at the chart above. You see that there are three (3) categories of "risk". "Low risk" investments obviously don't involve a lot of situations where you'd lose money. But, as you can guess, you won't make much money either, as the interest rate and "rate of return" is quite low. From there, there are "medium" and "high risk" investments.

Below the pyramid, you see fifteen (15) kinds of investment. Again, using the first chart AND your "cheat sheet", do your best to place the investments in their appropriate categories. You can make a pyramid on your answer sheet, or just do a bullet-pointed list...

Below are the "answers". DON'T CHEAT!!! TRY YOUR BEST, then scroll down to check your answers...

DON'T CHEAT! :-)

Below the pyramid, you see fifteen (15) kinds of investment. Again, using the first chart AND your "cheat sheet", do your best to place the investments in their appropriate categories. You can make a pyramid on your answer sheet, or just do a bullet-pointed list...

Below are the "answers". DON'T CHEAT!!! TRY YOUR BEST, then scroll down to check your answers...

DON'T CHEAT! :-)

ANALYSIS QUESTIONS:

- "Cash" is the lowest of "low-risk" investments. It simply means "saving cash", sometimes, literally, under your mattress. Why won't this get you a "return"?

- "Real estate" is owning land, usually in the form of housing and businesses. Why it is a "medium risk"?

- "Futures" are commodities like gold, oil, and metals. Why, in your opinion, are they the "highest risk, highest reward" investment?

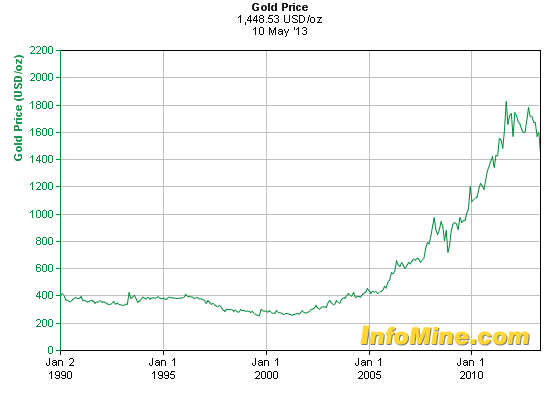

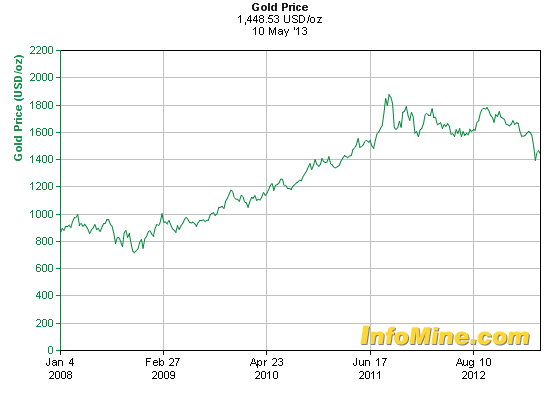

Have you seen these commercials and signs? It seems like everyone wants to buy your gold? Why? Well, it has to do with the price of gold, a very important "future", that carries a "high reward" with its price. Examine the graphs below:

Gold has always been valuable, but recently, since the late 2000's, its price has exploded! That's when these companies started to emerge. They know that if they buy your gold now, when the price is really high, they'll make a profit when the price eventually goes down. Look at the graph below.

Yes, the price is still high, but it's down, from its overall "high price point" of $1,900 per ounce last summer! At that time, those companies made money, hand over fist! High risk, and a very high reward!!

As a point of conclusion, read below:

As a point of conclusion, read below:

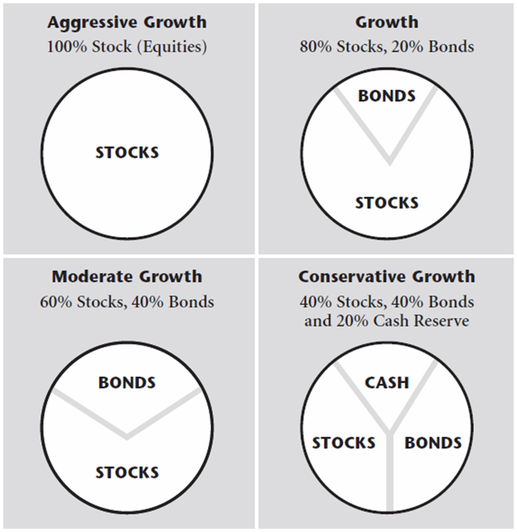

For all kinds of desired returns with all kinds of expected risk, there are “types of investment” for everyone:

- Low Risk / Low Reward......Savings accounts like CDs and government bonds

- Medium Risk / Medium Reward......“Making money grow” by real estate and corporate stocks

- High Risk / High Reward......“Rolling the Dice” with investing in future prices of commodities and “gut-feeling” stocks

PART IV: the stock market

Remember the "bulls and bears"? The "up's and the down's"? Stocks have them too! Let's start with some basics:

ANALYSIS QUESTIONS:

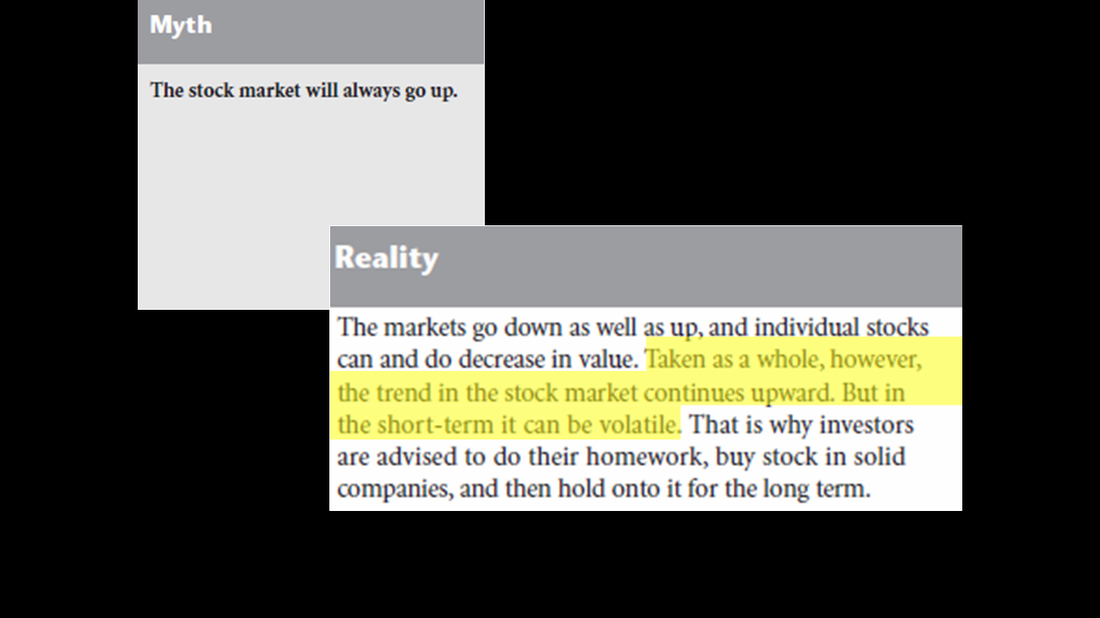

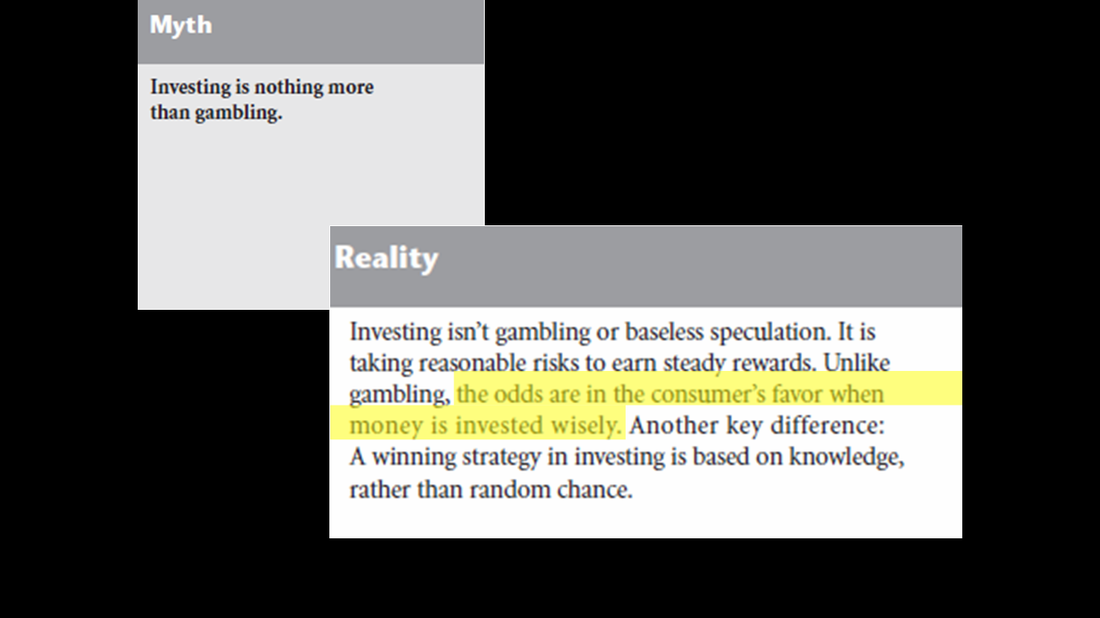

Let's examine some "myths" about the stock market:

- A "stock" is an investment that represents owing a “piece” of a company or corporation. When a business is “public” they are “traded” on the NASDAQ or the New York Stock Exchange (NYSE).

- A stock is sold in “shares” and when the stock price rises, it pays dividends.

- Often times, people will invest in “mutual funds”, a pool of stocks and bonds that are managed by professionals that attempt to make the holder the most money.

- Stock prices and success are determined by business success and economic factors.

ANALYSIS QUESTIONS:

- FILL IN THE BLANKS: Owning a "stock" is owning of "_____" of a company. You can buy a stock once it is "_____" (as opposed to "private"). Stocks are sold in "_____" and when a stock makes money, it pays "_____".

- What is a "mutual fund"?

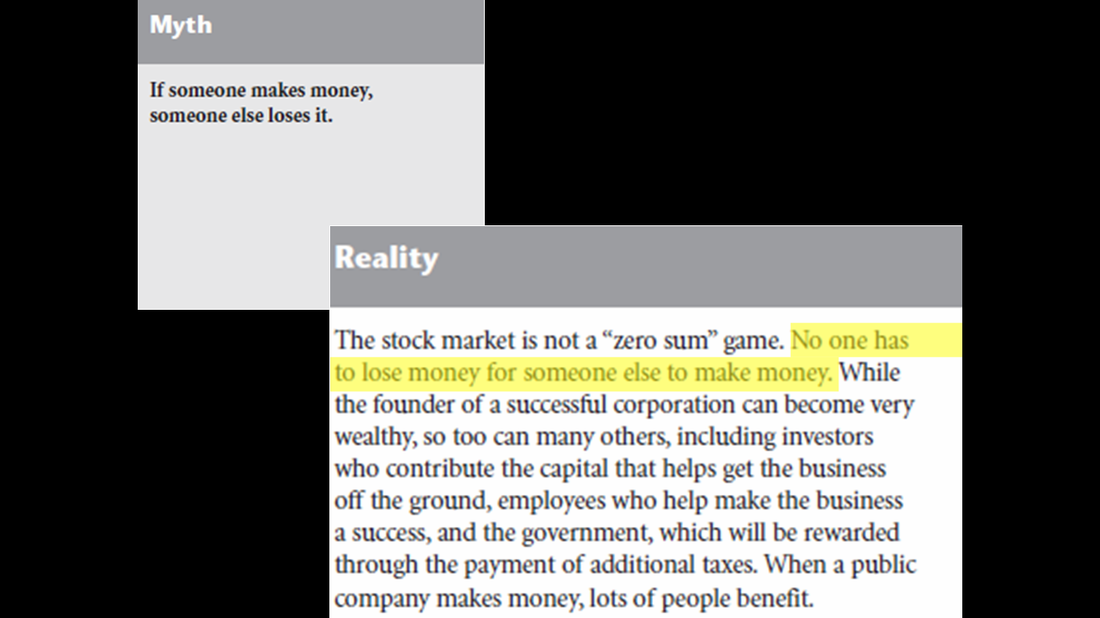

Let's examine some "myths" about the stock market:

ANALYSIS QUESTIONS:

- It's commonly believed in the stock market, for someone to "make money", someone else has to lose. Why is this NOT true?

- No, the stock market will not ALWAYS go up, but yeah...it kinda does. Look at the graph below. Why are stocks a good "long term" investment?

3. Why isn't "stock buying" like "gambling"?

Let's continue with this idea: stocks ARE risky, but a few key points of wisdom can go a long way. There is a very popular website called "The Motley Fool", which talks about investing. Click here to access a link that provides a few tips on how to "invest fool-ishly" (NOTE: In this case, a "fool" is a good thing, as that's what their website's called!) Answer the following questions:

- When buying a "stock", you should plan on "holding onto it" for a pretty long time: How far into the future should you look?

- What is meant by the term "temperament"?

- Under the "Emotional Roller Coaster" heading, why is it good to "tune out the noise"?

- What does it mean to "spread out your risk"? What about "buying in thirds?

- It seems like a lot of these investment tips fall under one category: DON'T FREAK OUT! When "playing the stock market", why is there a tendency to "freak out"?