Rubber Bands:

The Politics of of

Economic Connection and Economic Disaster

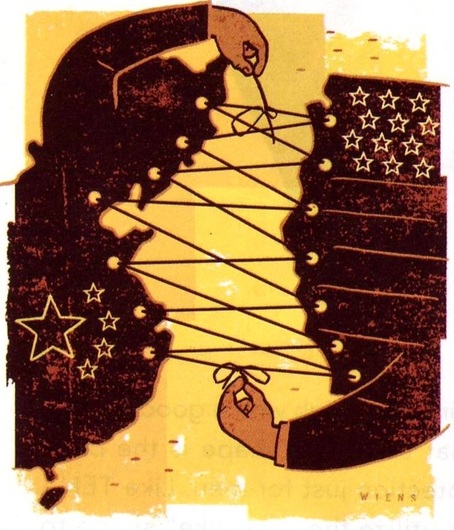

Economic connections are about as important as political ones: they allow for the free exchange of goods and services, with the promises of getting rich together! But what happens when these connections go sour? Do the disasters of one country echo in the foundations of the others? And furthermore, when it "rains", does it "pour" everywhere?

Before we play the "game" of global economics, you must educate yourself on the kinds of economic disasters. Read below, and then, as a class, we'll continue.

Before we play the "game" of global economics, you must educate yourself on the kinds of economic disasters. Read below, and then, as a class, we'll continue.

Part I: Economic Crises

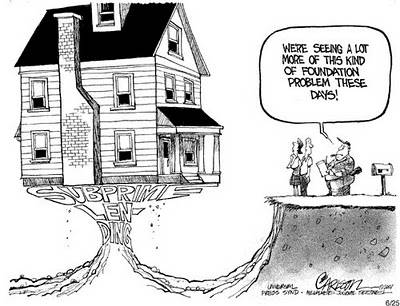

1. Domestic DefaultIn economic terms, a "default" occurs when a "buyer" of a certain item or product is unable to pay the debt on the purchase of that item. The most common form of default occurs with houses, cars, and credit card debt: the buyers purchase the items, hoping to pay them off over time, and when they are suddenly unable (because they're unemployed, the debt is too much, they've fallen on hard times, etc.), they find themselves in "domestic default".

|

When this happens on a gigantic scale (like it did in the 2007 housing crisis in this country), it affects everything! Think this way: If, suddenly, millions of people are poor, and are unable to pay the bills on their homes, what kinds of effects are felt by the banks? the loan companies? the insurance companies? Disasters on this large of a scale are called "domestic defaults" (massive, unpayable debts, in one specific country.

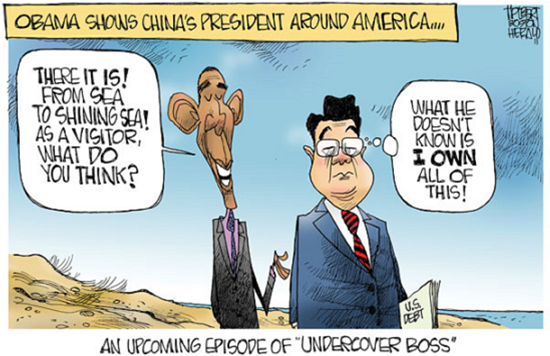

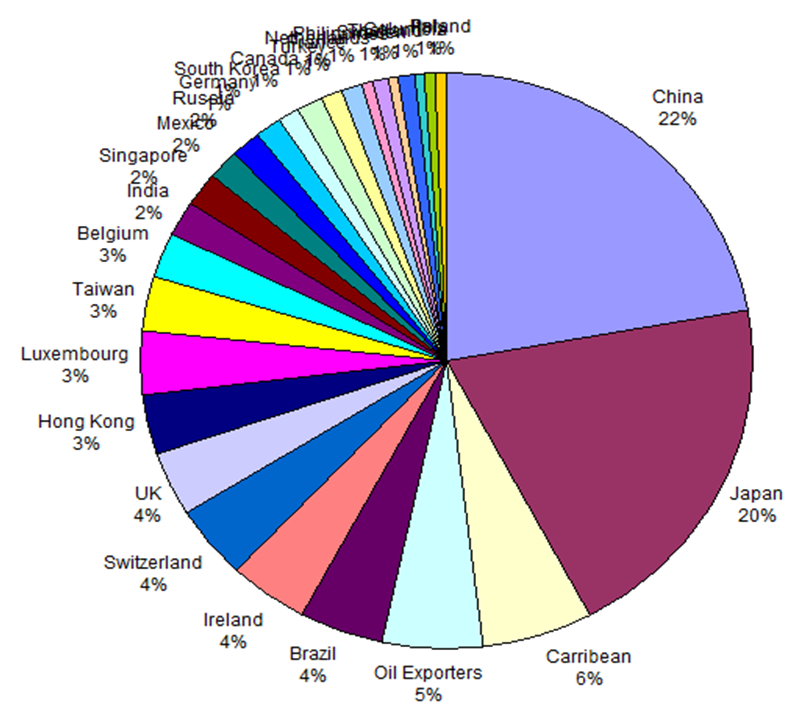

2. External DefaultSimilar to "defaults" defined above (when a "buyer" is unable to pay the debt on an item), an external default occurs when a country can't pay the debts it owes to other countries. As we've learned, the United States has been loaned billions of dollars by nations like China and Japan. We've payed off these debts over time.

|

But what happens if we can't pay those debts? The United States is a strong country, but let's flip it. What would happen to a smaller country like Honduras, for example, which suffers a terrible natural disaster, and isn't able to repay the money we've loaned them over time? This would be called an "external default" (massive, unpayable debt that one country owes to another).

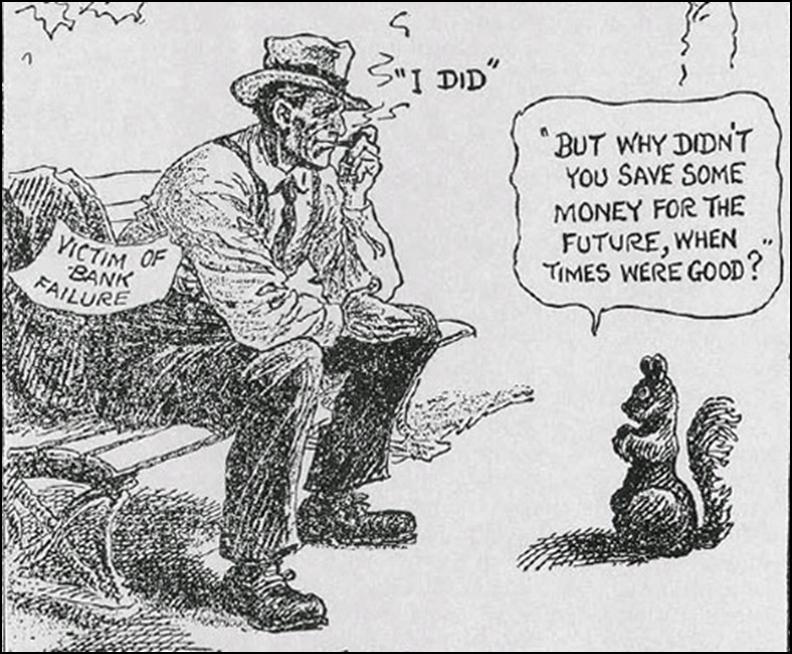

3. Bank FailuresIn the United States, we know that if you want to keep your money safe, you put it in the bank. But, what would happen if that bank failed, and the money you "saved" with them was suddenly not there? It happened here, in the 1930s! Prior to the Great Depression, banks lent out so much money that when people came to collect their savings, it wasn't there! Since then, our country has established securities and safeguards against it, but bank failures happen all the time!

|

In Argentina, in the 1990s and early 2000s, private banks helped their wealthiest customers invest in foreign nations and move $140 billion in private wealth out of the country and into foreign bank accounts--more than either the national GDP or the debt. Over 12 days of protest in December 2002, the country went through five presidents and would default on its $95 billion debt, It was the largest default in history, and all because the Argentine banks failed

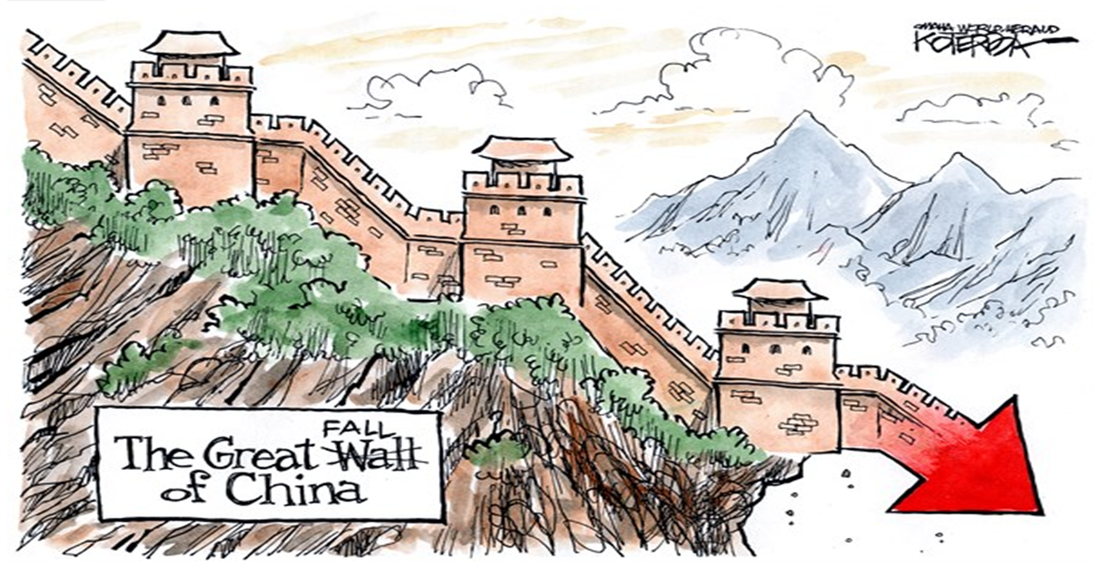

4. Currency CrashesToday, almost all currencies (money) are tied to each other: Today, $1.00 is worth 0.88 Euro, 0.69 British Pounds, 1.3 Canadian Dollars, etc., etc. But all nations base their currencies based on the values of others. So, if the United States "dollar" were to plunge for some reason, how would it affect the currencies of other nations? This kind of crisis is explained more below, but for now, just know that all currencies of all countries are closely linked!

|

5. Inflation OurburstLast unit, we discussed inflation: the increased price of goods due to devalued currency. See the cartoon on the right? The boy knows that pennies are worthless, and therefore, not worth even picking them up off the street!

When a country experiences inflation, almost all of the above disasters occur: domestic defaults result when the peoples' money is worthless. International debts cannot be repaid with undervalued currency. Bank failures occur when the money they loan is essentially worthless. And currency crashes happen when inflation affects the exchange rate with other countries! All (5) of these economic disasters rarely stay "inside" of a country and can have broad reaching, catastrophic effects! |

Part II: Types of

Economic Relationships

In this unit, we've discussed the importance of trade between countries. NAFTA, for example, sees the exchange of everything from agriculture to automobiles! But, in what other ways do countries "shake hands" with each other? Read below, and examine the "pro's" and "con's" of each action.

PRO:

- Establishes "friendships".

- Helps other nations in times of crisis.

- Once loans are established, they tend to be repeated.

- Nations loan money to others...with interest. So, a $1 million loan will be repaid at a 10% interest rate, for example, allowing the "lender nation" to make some money!

- Risk: What happens if that country doesn't pay back its debt?

- Default: Even if the country intends to pay its debt, what happens if it "defaults"?

- Lending to Enemies: Often times, your "loans" to other nations can make other nations angry!

PRO:

- Establishes "friendships", again.

- Allows for one nation to "watch and observe" the developments in other countries and then chose when to "go in and invest", and better yet, when to "pull out".

- Provide ways for other nations to invest in your country as well.

- Risk: What happens if that country, or that business, falls apart?

- Culture Shock: Sometimes, there are cultural changes and developments that can't be foreseen by other outside nations

- "In Too Deep": Investing in other nations requires time, and if and when crisis happens, takes a long time to protect oneself.

3. Foreign BankingOften times, American businesses, for example, will run their businesses through foreign banks. Why? Because other banks have different rules, different taxes, and different laws. It's not illegal, at all, but it is risky. Additionally, since currencies are different, businesses might engaged in all currencies.

|

PRO:

- Often times, "banking rules" in other nations are better than those in your home country!

- Allows for more international connection. A medical technology company, for example, might find success dealing with a foreign bank in a country with a high medical need.

- Taxes: Banking and finances done in other countries can save you from "taxes" at home.

- Risk: What happens if that country, or that business, falls apart?

- "In Too Deep": Banking in other nations requires time, and if and when crisis happens, takes a long time to protect oneself.

- Currency Crashes: Though your business might be "American", for example, the foreign bank is tied to the currency of that particular nation!

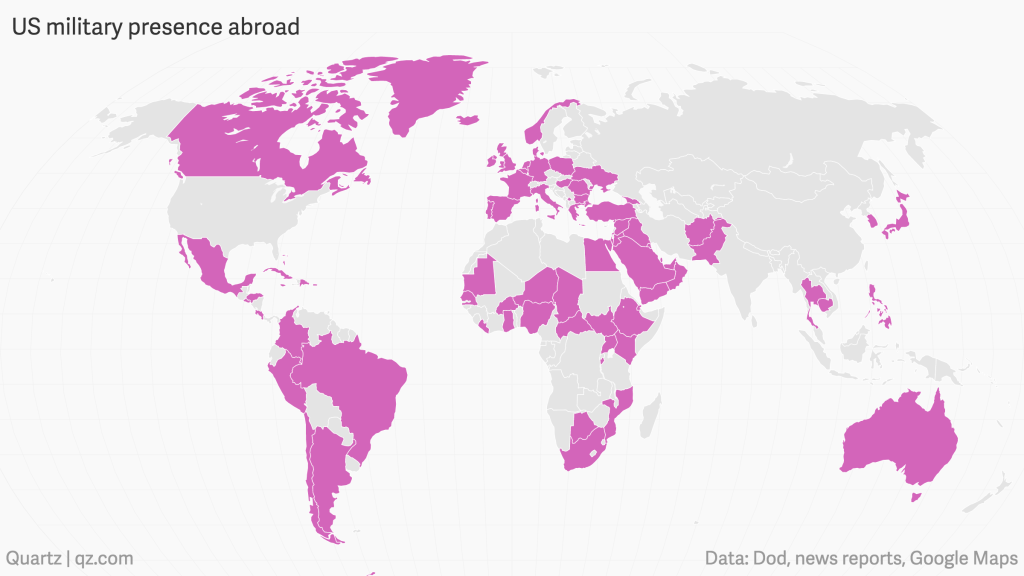

4. Foreign PersonnelThough not purely economic, the "exchange" of personnel (troops, government officials, cultural representatives) is a very important part of international connection. Look at the map on the right of the nations that "house" American troops: isn't there some kind of economic connection there as well?

|

PRO:

- Establishes "friendships".

- Helps other nations in times of crisis.

- Protections at home as well! International "personnel" can help establish safeties domestically.

- Risk: What happens if that country goes into crisis?

- Enemy creation: Exchange of military and government members can enrage other countries.

Part III: Wrap Your 'Bands'!

|

If I gave you 10 pennies with which you can invest, how would you do it?

We will play a "Spin the Wheel"-game, that will display certain scenario for each round. Keep track of your earnings, wins, and losses. You can choose to reevaluate and reassign your money as the rounds go on. Though the game is fun, remember the essential questions: |

- What are some of the "risks" of "international connection"?

- How does a domestic crisis become an international crisis?

- Can a nation isolate the "rain" in another country, so that it doesn't "pour" in theirs?